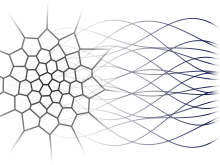

We review optimal quantization methods for numerically solving nonlinear problems in higher dimension associated with Markov processes. Quantization of a Markov process consists in a spatial discretization on finite grids optimally fitted to the dynamicsof the process. Two quantization methods are proposed: the first one, called marginal quantization, relies on an optimal approximation of the marginal distributions of the process, while the second one, called Markovian quantization, looks for an optimal approximation of transition probabilities of the Markov process at some points. Optimal grids and their associated weights can be computed by a stochastic gradient descent method based on Monte Carlo simulations. We illustrate this optimal quantization approach with four numerical applications arising in finance: European option pricing, optimal stopping problems and American option pricing, stochastic control problems and mean-variance hedging of options and filtering in stochastic volatility models. |