Vector quantization has been initially developed in the early 50's. The aim was to optimize the transmission of stationary signals. In this context, quantization was a process of signal discretization. A large part of this work has been done in Bell laboratories.

Having long been confined to signal processing, optimal quantization rose in the mid-1990s the interest of several research teams in probability in France (LPMA-UMR 7599 Univ. Paris 6 & 7, LAMA-UMR 8050 Univ. MLV - Paris 12) and in Germany (Faculty IV-Mathematik Univ. Trier, Institut für Mathematik Technische Univ. Berlin, Fakultät für Informatik und Mathematik. Passau).

Quantization methods now have their place in numerical probability, especially for solving problems arising in mathematical finance such as:

- the pricing of American options on multiple underlyings [1],

- the volatility estimation by filtering in stochastic volatility models [2],

- the pricing of exotic options (Asian options in Heston or SABR models...) and interest rate derivatives (CIR models...) using the so-called "cubatures" formulas [3].

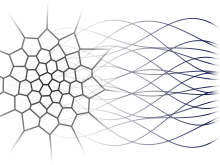

The research and the development in the field of vector quantization (finite-dimensional signals) continues today, mainly in connection with applications in signal processing and numerical probabilities. The explosion of computing capabilities in recent decades has both been a motivation and a driving force behind the development of such numerical methods.

Meanwhile, a new field emerged last decade under the name "functional quantization". This is to extend the concept to the infinite dimensional setting.

From applications viewpoint, it comes to optimally discretize the path space of a stochastic process that is to say, a dynamic random phenomenon. The archetype of such a process is the Brownian motion. These recent works are the basis of path-dependent option pricing methods discussed below. (See [4].)

The first chapter of Afef Sellami's PhD thesis [2] is an excellent introduction to optimal quantization (in French). The introduction is available separately. In [5], principal quantization-based numerical methods for finance are reviewed.

References

- "A quantization tree method for pricing and hedging multidimensional American options", Mathematical Finance, vol. 15, no. 1, pp. 119-168, 2005.

- "Méthodes de quantification optimale pour le filtrage et applications à la finance", Applied mathematics: Université Paris Dauphine, 2005.

- "Functional quantization for numerics with an application to option pricing", Monte Carlo Methods and Appl., vol. 11, no. 11, pp. 407-446, 2005.

- "Functional quantization of Gaussian processes", Journal of Functional Analysis, vol. 196, no. 2: Academic Press, pp. 486–531, December, 2002.

- "Optimal quantization for Finance: from random vectors to stochastic processes", Handbook of Numerical Analysis, vol. 15, 2008.