Introduction

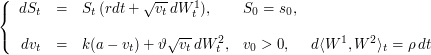

The following stochastic volatility model for the stock price dynamic in an incomplete market was introduced by Heston in 1993 [1]. Under a Risk-Neutral probability  , it writes:

, it writes:

|

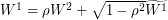

where ![$ \rho \in [-1,1] $](/sites/default/files/tex/91ef26f870ae28b2f658c46755bb216d064310f5.png) and where

and where  are such that

are such that  . Here

. Here  and

and  are two standard Brownian motions under the probability measure

are two standard Brownian motions under the probability measure  . Consider the Asian Call option of maturity

. Consider the Asian Call option of maturity  and strike

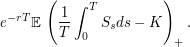

and strike  for which there is no explicit formula:

for which there is no explicit formula:

|

As a first step, we project  onto

onto  , so that

, so that  where

where  is a standard Brownian motion independent of

is a standard Brownian motion independent of  under the probability measure

under the probability measure  . Then

. Then  writes

writes

| TeX Embedding failed! |

where  .

.

Consider now  and

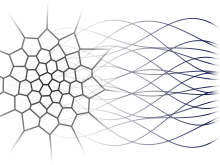

and  two functional quantizers of the Brownian motion.

two functional quantizers of the Brownian motion.

| TeX Embedding failed! |

where tabs  andt

andt  are available here.

are available here.

For  and

and  , we numerically solve the following ordinary differential equations.

, we numerically solve the following ordinary differential equations.

| TeX Embedding failed! |

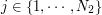

(Here, we used a Runge Kutta IV method.) The option price is now approximated by

|

Numerical test

Here, we propose a method to compute the Asian call option price based on the functional quantization of the Brownian motion as described in article [2] (section 8).

Here  et

et  are the sizes of optimal functional quantizers of the standard Brownian motion (

are the sizes of optimal functional quantizers of the standard Brownian motion ( "points", i.e. paths, for

"points", i.e. paths, for  et

et  for

for  ). Parameter

). Parameter  stands for the number of time-steps used to solve the ordinary differential equation written above. (We used a fourth order Runge Kutta scheme). Each grid couple yields a price approximation. The final result is a Romberg extrapolation between both prices, based on a

stands for the number of time-steps used to solve the ordinary differential equation written above. (We used a fourth order Runge Kutta scheme). Each grid couple yields a price approximation. The final result is a Romberg extrapolation between both prices, based on a  rate of convergence for the quadrature error.

rate of convergence for the quadrature error.

The following program was developed with the C programming language, and interfaced with Ruby. You can contact the authors for the source code.

The site team would like to thank David Delavennat (CNRS ingeneer at LAMA-UMR 8050 Univ. MLV - Paris 12 from 2003 to 2007) for his advices on the Ruby interface.

References

- "A closed-form solution for options with stochastic volatility with an application to bond and currency options", The Review of Financial Studies , vol. 6, issue 2, pp. 327 - 343, 1993.

- "Functional quantization for numerics with an application to option pricing", Monte Carlo Methods and Appl., vol. 11, no. 11, pp. 407-446, 2005.